IntraFi Network Deposits

IntraFi Network Deposits are a secure and convenient way to safeguard your deposits.

Cornerstone Bank customers can get 100% FDIC insurance coverage at no cost through our relationship with IntraFi and the programs they offer.

Who can use IntraFi Network Deposits?

Any individual with large deposits, businesses of all sizes, non-profits, government and municipal entities.

With IntraFi Network Deposits, you can:

- Enjoy peace of mind knowing that your funds are fully FDIC insured, up to $150 million per relationship

- Earn interest

- Save time by working directly with Cornerstone Bank

- Maintain flexibility

Learn more about IntraFi

Frequently asked questions

Why use IntraFi Network Deposits?

Enjoy Peace of Mind

Relax knowing that your funds are eligible for multi-million-dollar FDIC insurance, protection that’s backed by the full faith and credit of the United States government. No one has ever lost a penny of FDIC-insured deposits.

Earn Interest

Earn one interest rate per product option.

Save Time

Work directly with us ― a bank you know and trust ― to access multi-million-dollar FDIC insurance, and say ‘goodbye’ to tracking collateral on an ongoing basis, managing multiple bank relationships, manually consolidating bank statements, and other time-consuming workarounds.

Maintain Flexibility

Enjoy access to funds placed into demand deposit accounts and money market deposit accounts

Support Your Community

Feel good knowing that the full amount of your funds placed through IntraFi Network Deposits can stay local to support lending opportunities that build a stronger community.1

1 When deposited funds are exchanged on a dollar-for-dollar basis with other institutions that use IntraFi Network Deposits, our bank can use the full amount of a deposit placed through IntraFi Network Deposits for local lending, satisfying some depositors’ local investment goals or mandates. Alternatively, with a depositor’s consent, our bank may choose to receive fee income instead of deposits from other participating institutions. Under these circumstances, deposited funds would not be available for local lending.

How Does IntraFi Work?

Through just one bank relationship, you can access FDIC insurance from many. And you receive just one statement for demand and savings placements.

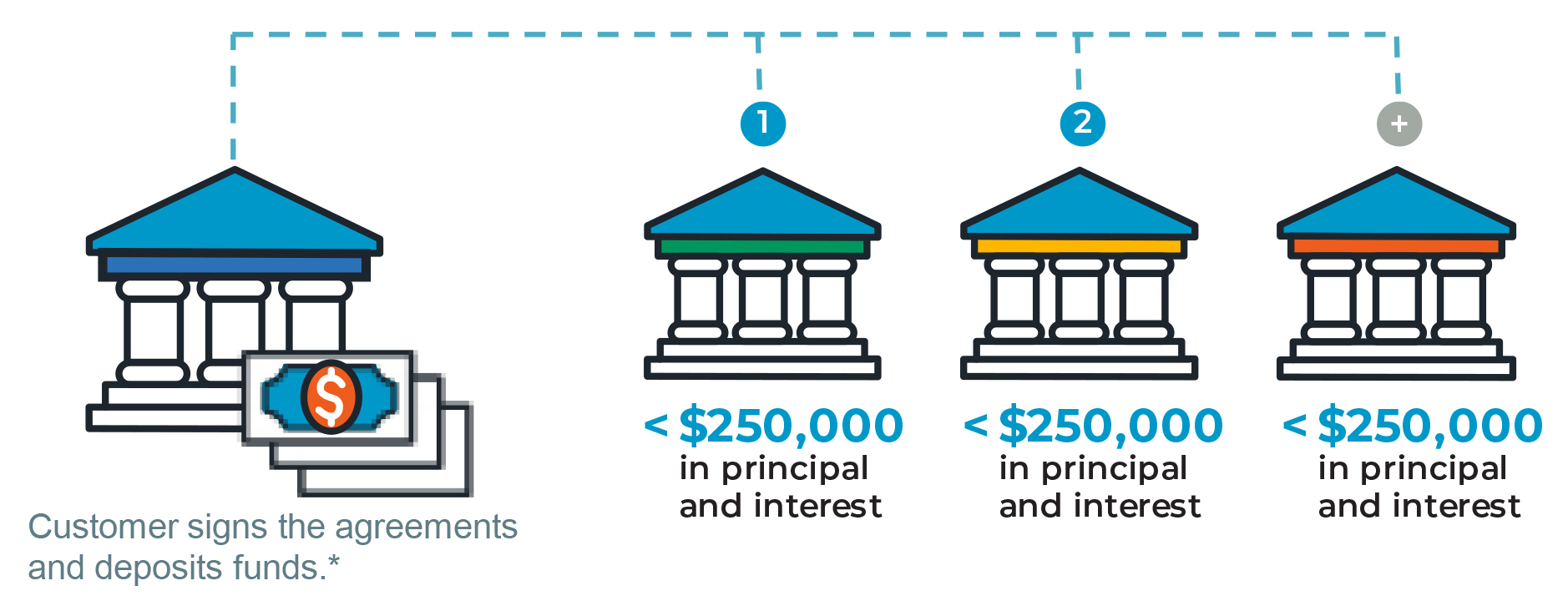

We, like other institutions that offer IntraFi Network Deposits, are members of a special network. When your organization uses the IntraFi Network Deposits to place funds, that deposit is divided into amounts under the standard FDIC insurance maximum of $250,000 and placed in deposit accounts at other FDIC-insured banks that participate in the same network.

*The depositor must have or set up a transaction account for the use of the IntraFi Network Deposits demand and savings options. If the depositor chooses both the demand and savings options, the depositor will need to have a separate transaction account for each.

Who can use IntraFi Network Deposits?

Individuals with large deposits, businesses of all sizes, non-profits, government and municipal entities can all use IntraFi.

How can I take advantage of IntraFi Network Deposits?

Contact Cornerstone Bank today using the form below, calling us at 800-939-9103, or visiting one of our branches.

Placement of funds through IntraFi Network Deposits is subject to the terms, conditions, and disclosures in the program agreements, including the Deposit Placement Agreement (“DPA”). Limits apply and customer eligibility criteria may apply. Program withdrawals may be limited to six per month for funds placed into MMDAs. Although funds are placed at destination banks in amounts that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”), a depositor’s balances at the relationship institution that places the funds may exceed the SMDIA (e.g., before settlement for a deposit or after settlement for withdrawal) or be ineligible for FDIC insurance (if the relationship institution is not a bank). As stated in the DPA, the depositor is responsible for making any necessary arrangements to protect such balances consistent with applicable law. If the depositor is subject to restrictions on placement of its funds, the depositor is responsible for determining whether its use of IntraFi Network Deposits satisfies those restrictions. IntraFi Network, Network Deposits, and the IntraFi hexagon are service marks, and IntraFi and ICS, are registered service marks of IntraFi Network LLC.

Translate

Translate