Frequently Asked Questions

Our customers most frequently asked questions. If you have a question not listed below, please chat with us online or call us at 800-939-9103.

Online Banking FAQs

Who can I contact for login assistance with Online Banking?

Chat with us securely from your Online Banking or call Customer Service at 800-939-9103.

What if I forgot my Online User ID?

From the Login page, select “Forgot User ID” and complete the prompts and submit. Or call Customer Service at 800-939-9103 .

Can I update my Online User ID?

Yes. Select the Person icon at the top right, go to My Profile > Change User ID, follow the prompts and Update.

What if I forgot my Password?

From the Login page, select “Forgot password” and complete the prompts and submit. Or call Customer Service at 800-939-9103 .

Can I update my Password?

Yes. Select the Person icon at the top right, go to My Profile > Change Password, follow the prompts and Update.

Why am I sometimes asked to verify my identity?

For your protection, the system may prompt you to provide additional security information.

What if I do not recognize something while authenticating my identity?

DO NOT move forward. Chat with us securely from your Online Banking or Contact Cornerstone Bank Customer Service at 800-939-9103 .

How do I update or change contact phone numbers?

Select the Person icon at the top right, go to My Profile > Update Phone Number, follow the prompts and Update.

Why was online access to my account locked?

If your User ID, Password or verification prompt is incorrectly entered a number of times, for security purposes, your online banking will become locked. If your access is locked, please contact Customer Service at 800-939-9103 .

What is the difference between the current and available balance?

The available balance displayed on your deposit accounts includes your current balance minus any holds that you may have. Your available balance displayed does not include savings overdraft, unused reserve credit and assigned overdraft privilege limits. The available balance displayed on your loan accounts is the amount of the funds available for your use.

Mobile Banking FAQs

What is Mobile Deposit Capture?

Mobile Deposit Capture is a convenient way to deposit checks into your checking or savings deposit account quickly and easily from a mobile device including smartphones (iPhone and Android) and tablets.

How do I make a deposit remotely?

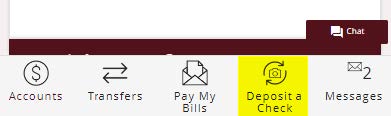

- Sign into our online banking site with our Cornerstone Bank mobile app. (You can download it on Google Play or iTunes App store).

- Select Deposit a Check. (Located in the footer)

- Before scanning your check for deposit, sign the back and include “Mobile Deposit Only.” If available, place a checkmark in the box indicating mobile deposit.

- Choose the account that you want to deposit into each time you make a deposit.

- Enter the value of the deposit

- Best practice: Place the check on a dark background > Select the “Front of Check” to capture the image > Flip the check over, select “Back of Check” to capture the image.

- Deposit.

Can I select a default account?

No. The “Deposit To” account must be selected for each mobile deposit.

How long should I keep a copy of the check?

We recommend 14 days.

What type of checks cannot be deposited?

See the Online Banking Agreement for the full list. Types of checks that cannot be deposited include:

- Any third party check (any item that is made payable to another party and then endorsed to you by such party).

- Any check previously converted to a “substitute check”, as defined in Regulation CC.

- Any item issued to you through a financial institution in a foreign country.

- Checks or items not payable in United States currency.

- Any item that has been re-deposited or returned such as “Non-Sufficient Funds” or “Refer to Maker” or returned for any other reason.

My check is endorsed. Why do I keep getting the error message “Endorsement Missing”?

Ensure your endorsement is done in blue or black ink and clearly visible.

When should I see my deposit?

- Qualified deposits made on a business day before 4:00 pm EST will be visible by 9pm EST that night or shortly thereafter.

- Qualified deposits made after 4:00 pm EST on a business day or weekend/holiday will be visible the following business day by 9:00 pm EST or shortly thereafter.

- For example, a qualified mobile deposit made on Friday at 5:00 pm EST will post to your account after 9pm EST on the following Monday. If Monday is a bank holiday then it would be Tuesday after 9:00 pm EST.

What is a qualified deposit?

A deposit that has been reviewed and accepted by the bank

- Examples of non-qualified deposits are checks listed above in item #5, checks not properly endorsed, post or stale dated checks.

- We will contact you if a deposit is unqualified

Will there be a hold placed on my account?

- The bank may place a Case-by-Case or exception hold. If the funds are held, we will provide a notice.

- New Accounts will have holds placed in accordance with our Funds Availability Policy.

How will I know if my mobile deposit is accepted?

- After submitting the deposit, you will receive an email acknowledging receipt and indicating it is pending review.

- We will notify you of any rejected items.

- Approved deposits are made available according to our standard Funds Availability Policy.

Bill Pay FAQs

How do I add payee?

Go to the Pay My Bills > Select the Add a Company or Person button > Select Company or Person > Fill in the data > Add.

How do I edit a payee?

Edit a Company: From a desktop computer > Pay My Bills > Select Company you wish to edit > go to Account Number > Select Change. You may receive a captcha prompt. > Enter New Account Number and Confirm new Account Number > Save Changes.

Edit a Person: From a desktop computer or in full site view > Pay My Bills > Select the Person you wish to edit > Enter the new information > Save Changes.

How do I delete a payee?

Pay My Bills > Select the Company or Person you wish to delete > Select Delete > Confirm Delete.

How do I set up a recurring payment?

Pay My Bills > Pay My Bills > Select the Company or Person you wish to set up a recurring payment for > Select AutoPay > Set Up AutoPay > Follow the prompts > Start Sending Payments > Review Confirmation & Close. The scheduled payment will now show in the “Pending Payments” queue.

How do I edit a scheduled payment?

Pay My Bills > “Pending Payments” queue > Select Change > Change this payment (adjust just that payment) > Save Changes.

To edit of change an AutoPayment: Pay My Bills > “Pending Payments” queue > Select Change > Change AutoPay Options (adjust all recurring payments for that payee) > Make updates > Save Changes.

How do I delete a scheduled payment?

Pay My Bills > “Pending Payments” queue > Select Cancel > Cancel payment or Stop AutoPay series > Cancel Payment or Stop AutoPay > Return to Payment Center.

Are Bill Payments issued through different methods?

Yes. Our Bill Pay service provider may issue the payment electronically, as a corporate check (drafted from the Bill Pay service provider’s account) or a laser draft check (drafted from your account).

How will I know which payment method was issued?

The method (Electronic or Check) is reflected in the top right side of payment confirmation page. We will also provide you with an approximate deliver by date.

Will my payments always use the same method?

No. Our Bill Pay service provider determines the method for each and every bill payment. It is best practice not to depend on a payment always processing by the same method.

When are Bill Pay payments deducted?

Electronic payments and Corporate checks are typically deducted from the funding account the same day the payment is issued.

Draft Checks are drawn off your account. Therefore, they will post to the funding account when payee processes the payment.

Translate

Translate